Latest weekly board (Aug 25–31): $127.8M total, $175,182 fees, 20,729 weekly users, 83.8% Ethereum share. Clean activity. No noise.

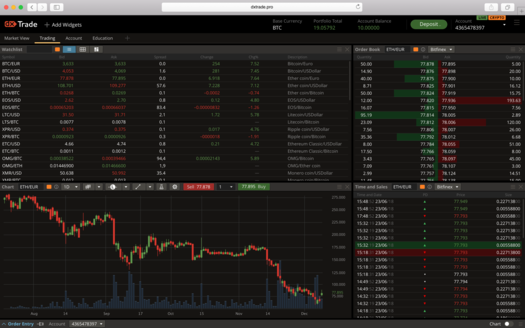

Banana Pro is the desk traders open first: a browser-based crypto trading platform with fast Solana swaps, built-in sniping, real limit orders, multi-wallet control, and routing you actually choose. The result is straightforward, less second-guessing, more filled orders that respect your rules.

The numbers that matter

- $127.8M on the 7-day leaderboard

- $175,182 fees (the truest signal of real trading)

- 20,729 users this week (9,202 returning, 1,152 new)

- 83.8% ETH share across tracked activity

- Chain mix: ETH ~$95M, SOL ~$4.8M, Base ~$4.6M, BSC ~$718K

Why this matters: when the fee line stays healthy, the flow is genuine and repeatable. You can’t spoof fees.

What’s inside the platform (and why traders stay)

- Fast execution

Low-latency Solana swaps and sniping right on the dashboard. - True order control

Slippage, price-impact caps, order duration, priority fee, tip, visible and editable before you fire. - Routing you pick

- MEV-protected (Jito) to reduce sandwich risk in heavy traffic

- Public route for raw speed to the next validator (pair with tight slippage)

- MEV-protected (Jito) to reduce sandwich risk in heavy traffic

- One-screen workflow

TradingView charts, dev/own-trade overlays, live transactions, Positions, Watchlists, and a proper Pending Orders panel. - Scale without clutter

Multi-wallet trading with per-wallet PnL and shareable position cards. - Security basics done right

PIN lock with timeouts, 2FA on your sign-in method, and private keys shown once, store them offline.

Execution playbook (copy, paste, trade)

Profile A: Liquid pair, you want speed

- Route: Public

- Slippage: tight (you set the ceiling)

- Price-Impact Limit: hard cap

- Priority: modest (you’re not fighting a launch)

Profile B: Hot launch, mempool pressure

- Route: MEV-protected (Jito)

- Slippage: conservative

- Priority + Tip: elevated (buy your place in line)

- Duration: match the catalyst window

Sniping guardrails (mandatory)

- Min/Max SOL liquidity to dodge dust and one-sided LPs

- Min tokens to avoid paper gains

- Price-Impact Limit so you don’t buy your own candle

“Show me in one minute”

- Log in (Google, Twitter, Telegram) or Connect Wallet for a quick swap

- Generate or import a Solana wallet (Phantom/Solflare). Save the key offline, no second chance

- Fund with SOL (transfer, CEX, or bridge)

- Set a PIN and session timer

- Trade from Dashboard or hunt fresh deploys in The Trenches (Pump.fun, Moonshot)

Signals this week

- A headline corporate ETH allocation put institutional demand back in focus

- A targeted $1B Solana treasury drive (top names) points to deeper capital for SOL infrastructure

- Public-sector pilots putting official data on-chain; the flip side is renewed attention to operational security across venues

None of this is theory. It’s the backdrop that rewards platforms where route selection and execution dials are explicit.

- Verifiable metrics: $127.8M board, $175,182 fees, 20,729 users, 83.8% ETH share

- Clear angle: fee resilience and route transparency in a week when quality flow mattered more than headline noise

- Demonstrable UX: snipes, limits, positions, pending orders, and multi-wallet, on one surface

BananaTV: the two-minute brief

Short, punchy video rundowns flagging ETF flows, listings, policy moves, and on-chain rotations. Watch the update, then act inside Banana Pro, set snipes, place limits, rebalance. No wandering.

FAQ

What is Banana Pro?

A crypto trading platform in your browser. Fast Solana swaps, sniping, limit orders, MEV-aware routing, multi-wallet trading, charts, and portfolio views—no command line, no detours.

Do I need an account?

No. Connect a wallet for a one-off swap. Create an account to unlock saved layouts, full widgets, and PnL views.

How do I avoid getting sandwiched?

Pick MEV-protected (Jito) during heavy traffic. If you switch to Public for speed, keep slippage tight and enforce a Price-Impact Limit.

Where can I verify the figures?

In this week’s recap. The board total, fees, user counts, ETH share, and chain mix are published numbers.

Can I export my private key later?

No. You see it once on creation. Store it offline immediately.