The first time I saw a wallet drain happen in real time, the person was still convinced they had clicked a harmless button. They were not careless. They were rushed, distracted, and primed by a believable story. One moment their wallet showed a normal balance. The next moment, the tokens were moving out in a sequence of transactions that looked like a row of dominos falling. That shock is why these incidents feel so violating. It is also why the response must be practical. Your job is not to argue with the scammer or chase them in DMs. Your job is to slow the bleeding, preserve evidence, and report in a way that another team can act on.

People often call any crypto loss a scam, but wallet draining is a specific pattern. It usually involves an approval or signature that gives a malicious contract permission to move assets, or it involves a fake site that captures a secret, or it uses social engineering to push you into signing something you did not understand. The attacker does not need to hack the blockchain. They only need you to grant access. That is why prevention and reporting both start with the same truth: what you signed matters more than what you thought you clicked.

What a wallet drain looks like in real life

A drain rarely looks like a single dramatic theft. More often it looks like fast, tidy bookkeeping from the attacker’s point of view. Your wallet sends one token, then another, then perhaps your NFT, then whatever small balance remains. In some cases, the attacker triggers an allowance that lets them pull funds without you initiating each transfer. To the victim, it feels like the wallet is leaking. To the chain, it looks like authorised actions.

There are a few common real life set ups I see repeatedly. Someone receives a message offering an airdrop, a whitelist spot, a trading bot, or a recovery service. They are told to connect their wallet and verify. The site prompts a signature that is framed as harmless. Another common set up is a fake support chat. The person believes they are talking to an exchange or wallet provider. They are walked through steps that end with exposing a secret phrase or confirming a malicious approval. A third set up is romance or investment persuasion. The victim is coached, over days, to treat the scammer as a trusted advisor.

These patterns are not limited to crypto native communities. The same persuasion tactics show up in broker fraud, fake platforms, and social media impersonation. A person might enter the crypto space after seeing a flashy ad or a celebrity themed pitch. That is where labels like fake Elon Musk scam appear in reports. The label is not the point. The point is the mechanism, the exact claim, and the exact link between that claim and what you signed.

People also get tripped by familiar names. I have seen victims mention terms like CriptoIntercambio scam and H5 NextLeap Smart Investment scam when they realise the brand they trusted does not exist in any legitimate register. When wallet draining is linked to a broader fake platform story, you should document both the social narrative and the technical action, because the combination explains why you signed.

The most common technical traps (approvals, fake sites, phishing)

Approvals are the trap I treat as the default until proven otherwise. Many tokens follow standards that require you to approve a contract to spend your tokens. The legitimate version of this is how decentralised exchanges work. The malicious version is an approval that grants an attacker’s contract broad permissions. Once that approval exists, the attacker can call transfer functions and move assets out, sometimes without you signing each move.

A second trap is blind signing. Some wallets show sign message or sign typed data prompts that users accept without reading. Attackers use this to smuggle in permissions or to trick you into signing something that authorises transfers. Even if you are careful, the wording can be confusing because wallets are not consistent in how they display details. This is why your evidence capture must include the exact transaction or signature, not only screenshots of the UI.

A third trap is a fake site that looks like a well known protocol. The URL is close, the design is cloned, and the popup is familiar. You connect, sign, and the drain begins. People often say they were phished, but what matters for reporting is which fake domain you used, where you found the link, and what the site asked you to sign. I keep those domain identifiers inside the private evidence file and only paste them into official reports or abuse forms that request them.

A fourth trap is account takeover on your email or social accounts, which then leads to wallet compromise. If an attacker controls your email, they can reset exchange accounts. If they control a social account, they can message your friends with the same lure that caught you. That is why the response plan cannot stay inside the wallet. The wallet is one door. Your identity is the whole house.

Sometimes scam communities give their campaigns internal names or victims repeat a name they saw in a warning post. If you were targeted by something described as XA50B Wallet-Drainer Scam, treat that as a searchable label to include once in your report. It can help investigators connect multiple complaints to the same pattern, but it does not replace on chain proof.

What to do in the first 30 minutes

Speed helps, but panic hurts. In the first half hour, I focus on three goals: isolate, preserve, and notify. I also keep the actions simple enough that a stressed person can actually do them.

First, isolate the wallet session. Disconnect your wallet from the site you used. Close the browser tab. If you used a mobile dapp browser, close it fully. If you suspect malware or a remote access session, disconnect from the internet until you are on a safer device. The reason is plain: if your browser is still connected to the malicious site, you may trigger more approvals or signatures without realising.

Second, stop further asset exposure. If you still control the wallet and it is not fully drained, move remaining assets to a new wallet that you create on a clean device. Do not reuse the same seed phrase. Treat the old wallet as compromised until you understand exactly what happened. If you have NFTs or assets that cannot be quickly moved, your next best step is to revoke approvals, but moving assets first can be faster when seconds matter. I avoid complicated steps that require navigating multiple tools while someone is shaking.

Third, preserve evidence while it is fresh. Open a block explorer and copy the transaction hashes that show the outgoing transfers. Save the wallet address, the destination addresses, and the timestamps. Take screenshots of the wallet history, but do not rely only on screenshots. Export any chat logs with the scammer, especially the message that sent the link you clicked.

Fourth, notify the places that can act quickly. If you sent funds from a centralised exchange or your assets touched an exchange, open a support ticket and include the transaction hashes and destination addresses. Exchanges cannot reverse blockchain transfers, but they can flag addresses, warn other users, and cooperate with law enforcement requests. If the scam link came through a social platform, report the account immediately to reduce spread.

Fifth, freeze your wider identity risk. Change your email password, enable two factor authentication, and check for new forwarding rules. If your email is compromised, wallet draining is only one symptom. I also check password reset logs and recent logins on major services. This is boring work, but it prevents the attacker from hitting you again from a different angle.

This is also the moment when victims are most vulnerable to recovery predators. If someone messages you offering to recover funds for a fee, treat them as a second scam. You can report them later, but do not engage now. Your job is to stabilise.

Evidence to capture for reports tx hashes, approvals, screenshots

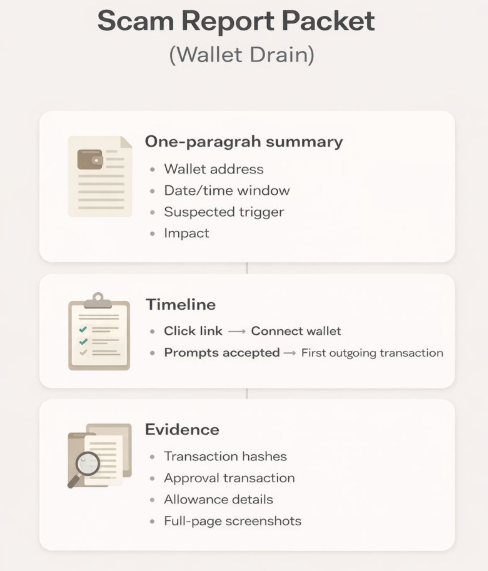

A useful report is a packet, not a rant. I build the packet in a way that any reviewer can scan in a minute and understand what happened. I start with a one paragraph summary, then a timeline, then evidence.

The summary should state the wallet address, the date and time window, the suspected trigger, and the visible impact. For example, you might say you connected to a site after receiving a message, you signed an approval, and funds left your wallet. If you do not know the trigger, say that clearly. Guessing wastes time.

The timeline should capture key points: when you clicked the link, when you connected the wallet, what prompts you accepted, and when the first outgoing transaction occurred. If you had a chat with the attacker, include the time stamps of the messages that pushed urgency.

The evidence should include transaction hashes for each outgoing transfer and the approval transaction if it exists. Many drains involve an approval followed by transfers. That approval is the key in the story. If you can, capture allowance details from a reputable token approval checker, but again keep it factual. Approval granted to contract address X at time Y is useful. They hacked me is not.

Screenshots still matter, especially when they show the fake site prompt, the misleading language, or the social post that lured you. Capture the full page, not a cropped fragment, so it is clear where the claim appeared. If you interacted with a fake support chat, screenshot the handle, the profile details, and the message that instructed you to do something risky.

If your case began as an investment pitch and then turned into a wallet drain, include that context once. People sometimes connect the story to a broader fake platform they were using. They may mention labels like Defi-trade.com scam or www.mcexexchange.com scam because that is how they searched for information after the loss. You should not paste those domain looking identifiers all over public pages. Keep them inside your report file and only enter them into official forms that request a domain or platform name field.

If you want a well structured reference for complaint writing beyond crypto, I sometimes point people to How to Report a Fake Trading Platform and File a Complaint against a Broker because it reinforces the same discipline: timeline, evidence, and clear requested actions.

When and how to contact exchanges and support teams

Contact exchanges as soon as you can produce a clean evidence summary. Support teams move faster when you give them the exact data they need. I include the wallet address, the transaction hashes, the destination addresses, and the time window. I also include the exchange account email or user ID if relevant, but I do not overshare sensitive documents in the first message. Support teams often ask for further verification later.

If you bought crypto on an exchange and withdrew to the compromised wallet shortly before the drain, tell the exchange that sequence. It helps them understand that your funds moved through their rails. If any funds were sent to a deposit address that belongs to an exchange, that is especially important. Exchanges may be able to place internal flags on accounts that receive stolen assets. This is not a promise of recovery. It is a realistic attempt at containment.

When you contact wallet providers, keep expectations grounded. Non custodial wallet apps do not control your funds. They cannot reverse transactions. What they can do is help you understand the signature type, identify known phishing domains, and guide you to revoke approvals. Their logs may also help you confirm which dapp connection was active.

When you contact a social platform because the lure came from an account, include screenshots and the message link. Platforms are more likely to act when you demonstrate impersonation or harmful fraud.

If your local context matters, you can also report to cybercrime channels where you live, especially when identity theft, extortion, or repeated targeting is involved. The aim is to create a reference number and contribute to pattern detection.

How to file a structured complaint

A structured complaint reads like a case file, not a confession. I write it in calm language, and I stick to verifiable facts. I explain what happened, how I discovered it, and what actions I already took. Then I ask for specific next steps.

I open with a short statement: I believe I have been the victim of a crypto wallet draining incident. I provide the wallet address and the incident time window. I state the suspected trigger, such as signing an approval after connecting to a site received in a direct message, if that is true. I then list the transaction hashes and destination addresses. This is where the chain becomes your witness. Anyone can verify it.

Next I provide the supporting context. I mention how I was approached, what the message claimed, and why I believed it. If it was linked to an investment narrative, I include the platform name I was shown, once, and I keep it neutral. If the scam used celebrity framing, I mention that. If I saw a label in the wild, I include it once, like the earlier XA50B Wallet-Drainer Scam reference, because it can help connect cases.

Then I state what I want from the recipient. For an exchange, I ask them to flag the destination addresses and confirm whether any are linked to accounts they control. For a regulator or cybercrime unit, I ask for a reference number and guidance on any next reporting steps. For a social platform, I ask for account action and preservation of records.

If you want a single place to keep your complaint text consistent while you submit it to multiple destinations, I use Financecomplaintlist to organise the timeline, the evidence links, and the text blocks so I can adapt them without drifting into contradictions.

If you also need a broader guide that covers non crypto company legitimacy checks, I refer people to How to report an illegitimate company because many wallet drain victims were first persuaded by a business story, not by a technical prompt.

Preventing repeat compromise (device/account security)

After the first report is filed, your priority becomes preventing a repeat hit. Attackers often try again because they know you are stressed. They may email you posing as support. They may message you offering recovery. They may target your friends through your compromised social account.

Start with the device. If you suspect malware, move wallet activity to a clean device. Update your operating system and browser. Remove suspicious extensions. Check remote access tools and uninstall anything you did not intentionally install. Use a reputable password manager and change passwords from a safe environment.

Lock down your email, because email is the master key for most accounts. Enable two factor authentication. Review recovery options. Remove unknown devices. Check for forwarding rules. If your email is safe, the attacker has fewer paths back into your life.

Review your exchange accounts. Enable two factor authentication with an authenticator app. Turn on withdrawal allowlists if available. Review API keys and delete anything you do not recognise. If you used the same password across services, rotate it everywhere.

Review your wallet hygiene. Use a separate wallet for high value holdings and a separate wallet for risky connections. Treat the spending wallet like the cash in your pocket. Keep only what you are willing to expose to unknown sites. When you connect to a new dapp, read the prompt, check the domain, and slow down. Scams rely on speed.

If you need a final set of actions to keep you on track without spiralling, I keep it short and practical: preserve evidence, contact the exchange if relevant, file your complaint, secure your identity, and warn your community with redacted facts. For a structured place to submit and track those steps, use Report Scams so your case stays organised across follow ups and you do not have to rebuild the story every time a new team asks for details.