In a digitalized and hyper-connected world, the online world has taken the center stage in our daily interaction, transactions, and experiences. Including social networks and gaming, fintech and e-commerce, digital ecosystems have brought unlimited opportunities. However, with the growth of these platforms, so does the problem of fraud, security and user authenticity. It is there that KYC Verification comes in as an essential factor in ensuring trust and transparency. Not only is it no longer merely a regulatory requirement; it has become the backbone of credibility in the digital world.

The Increasing Significance of KYC Check

With the ever-changing technology, online services are now closer than ever. This ease of access however also facilitates easy exploitation of platforms by malicious users. One of the pitfalls has become identity theft, fake accounts, and fraudulent transactions. To fight such threats, KYC Verification is going to identify all the users as who they are.

The digital platforms can ensure a safe environment where interactions are grounded on veracity by ensuring that a user is authenticated when registering or during the onboarding process. This is essential to the financial institutions and the business in other sectors such as gaming, e-commerce, and digital content. Any digital platform must have a trustworthy audience, and the KYC Verification is the surest way to make sure that no trust is violated.

The KYC Verification enhances security

Any online platform is under threat of cyber attack at all times. Even the most reputable brands can suffer because of phishing, fake profiles, and other fraudulent actions. KYC Verification is an effective defense mechanism as it confirms the identity of a user by verifying the documents issued by the government, biometric or some other credible source of data.

The process assists the businesses to remove the fake users, minimize frauds, and eliminate money laundering. It is also very essential in adherence to international policies aimed at safeguarding the information and economic interests of the users. Using KYC Verification, the platform will be able to identify suspicious actions at an earlier stage and proactively prevent possible risks. KYC in simple terms is a gatekeeper and a trust builder to the digital ecosystem.

Developing Trust in Relationships with the user

Trust is the currency of success in an online world where people are hardly ever physically present to each other. The websites that employ KYC Verification demonstrate a strong desire to keep the data of their users safe and transparent in all the interactions. Users tend to transact, participate in a platform, and be loyal when they can learn that the platform cares about their security.

There also is a ripple effect of trust. Confirmed users are more comfortable communicating with another on the same platform, whether buyers, sellers, game players, or the service providers. This will provide a safe environment in which actual users may flourish without fear of fraud or impersonation. In the long run, this improves the satisfaction of users and brand image, which enables the businesses to grow in a sustainable manner.

The KYC Verification and its role in Compliance

Conformance of regulators has been integrated as a fundamental aspect of online operations. Companies in the world are being required by governments and regulating bodies to have a high standard of identity verification, particularly the ones that make deals involving sensitive information or money. KYC Verification will assist organizations to comply with these legal requirements but at the same time remain convenient to users.

Those platforms that cannot meet the requirements of the KYC are harshly punished and their reputation is lost. Through the combination of effective KYC platforms, companies can operate within legal boundaries as well as display responsibility and accountability. Such compliance does not only avoid legal problems, but also creates a long term credibility amongst the users, investors and partners.

Smart KYC Processes to Enhance User Experience

The modern user wants to have a quick and smooth onboarding process. They may be discouraged by a long verification process, so that they will not go through with registration. Luckily, the development of digital technologies has turned Know Your Customer Verification into an effective and convenient system.

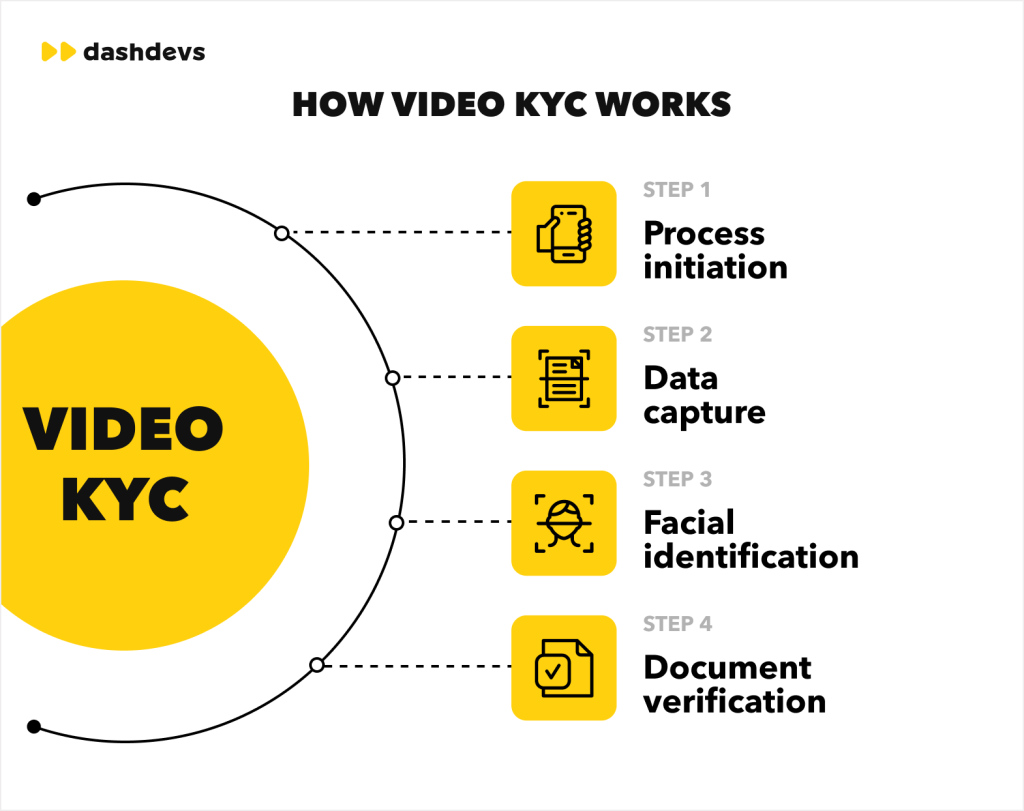

The process has been made easy by automated verification, AI-based facial recognition, and digital document scanning. The speed at which users authenticate their identities using their smart phones has increased to several seconds. This co-existence of security and convenience give platforms the ability to be compliant and offer smooth and positive user experience.

The user would form a perception of the platform as professional and reliable when they feel that they go through a hassle-free verification process. This leads to further interaction and the rapport between the users and the brand is enhanced.

KYC Verification to develop Business

KYC Verification also leads to business development, in addition to compliance and security. Authenticated customers will show greater interest in premium-services, secure their transactions, and place their faith in the new functions created by the platform. Verified data may also help businesses to know their audience better, personalize experiences, and develop specific marketing strategies.

Additionally, approved ecosystems can easily get partnerships with other organizations that value security and compliance. This makes the way to collaborations, investments and expansions which otherwise would not have been possible with a weak identity verification frame being there. Essentially, KYC Verification serves not only as a safeguard to the business, but also as the driver in the development of the business in the competitive digital environment.

The KYC Future in the Digital Age

With the growth of technologies, innovation will become the future of KYC Verification. Identity verification will be even more secure and efficient with the use of blockchain-based identity systems, biometric verification, and AI-powered analytics. These developments will see platforms provide more customized, open, and secure user experience in industries.

The current digital revolution requires all businesses, irrespective of their size and industry, to incorporate viable KYC systems. The ones, which do not keep up, will lose the trust of users and become outcompeted by others, which put the focus on identity verification and transparency.

Conclusion

Trust is all in the digital world. KYC Verification has changed to no longer being a regulatory imperative, but to the fabric of the contemporary digital environment. It protects the users, provides armour, improves compliance, and generates long-term credibility. It could be a banking company or a virtual auction, a gaming server or a mobile app, but any company that prioritizes trust and integrity has to integrate KYC Verification into its business model.

With the trend of expansions and innovations on the digital platforms, KYC will always be at the core of safe, transparent and user-friendly digital ecosystems.